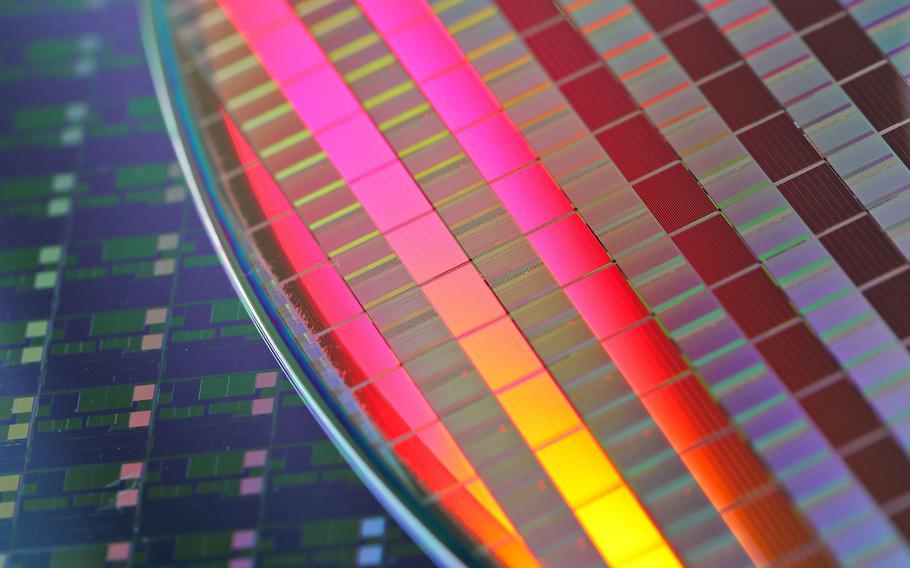

Silicon wafers made by Taiwan Semiconductor Manufacturing Co. (Maurice Tsai/Bloomberg)

(Tribune News Service) — Most Americans are unaware that the United States is already fighting a war with China that involves Taiwan.

This war isn't yet being fought with weapons. Instead, it is a battle to control the world's most critical technology: the design and production of microchips — on which virtually everything in our modern world depends.

From microwaves to smartphones to cars, from the stock market to missiles — our economy and military run on the tiny silicon chips that power computer systems. "We rely on them for all aspects of our daily life," I was told by Chris Miller, author of the important new book Chip War: The Fight for the World's Most Critical Technology. "Our society can't function without chips."

The United States used to be the global leader in designing and building the fastest chips, but its edge is slipping. China is investing billions in chip production for civilian and military uses in order to surpass us, while the Biden administration is moving to block Beijing's efforts. Meantime, the island of Taiwan — whose freedom Beijing constantly threatens — is the world's largest producer of the most advanced chips, which China would love to control.

So I recently did an InquirerLive video interview with Miller to discuss how the U.S.-China Chip War is likely to play out.

When the chip industry first developed in the 1960s and 1970s, it was located almost entirely in the United States. But over the last five decades, as chips grew more complex, countries began to specialize in separate parts of the chip-making process. "The U.S. remained the leader in designing and producing machine tools for making chips," Miller told me, "but when it comes to manufacturing chips, we have fallen behind."

In the early 1980s, Morris Chang, a Taiwanese American graduate of Stanford and MIT, was passed over as potential CEO at Texas Instruments — a snub that Miller called "one of the biggest business errors of the 20th century." Chang went on to accept an invitation from the Taiwanese government and established the Taiwan Semiconductor Manufacturing Co. (TSMC), which now manufactures 30% of the world's overall processor chips and 90% of the most advanced chips that power iPhones and computers.

The only companies potentially in position to compete with TSMC in chip manufacturing are South Korea's Samsung and the U.S. semiconductor company Intel. Russia isn't even in the game. China, still far behind in designing sophisticated chips, "has been spending more money on importing chips than importing oil," Miller said.

This poses a critical threat to future U.S. security. Modern warfare, Miller said, "will be more reliant than ever on chips." The military requires ever faster computing power for everything from autonomous (or unmanned) vehicles — such as drones and attack submarines — to radar systems, to communications and data processing, to other crucial systems.

"America is now betting the future of its military on a technology over which its dominance is slipping," Miller said. China and its army have been able to "buy foreign chipmakers, stealing their technology, and providing billions to subsidize Chinese chip firms and evade U.S. restrictions."

To thwart Beijing, the U.S. Commerce Department issued draconian export restrictions in October that block China from buying sensitive technologies for chip production, including advanced software and the machines needed to produce the chips. The Biden administration is also pressing reluctant allies, such as the Netherlands and Japan, not to sell China other key elements of the chip-making process. It is also discouraging Taiwan from selling advanced chips to Beijing.

Said Miller: "The Biden moves mean China will be unable to access the next generation of faster chips" that it needs for advances in artificial intelligence — including for its military.

Caught in the middle is Taiwan, whose biggest trading partner is China but which depends on Washington to prevent Beijing from seizing the island by force.

"The nightmare scenario," Miller said, "in terms of global economic impact, is if there would be a war in the Taiwan Straits. It is hard to think that chip production would not be affected, especially if production comes to a halt.

"Production of smartphones would be devastated, also PCs, data centers, cell phone towers" — along with cars and home appliances — and military operations. "There would be a massive long-term effect."

Aware of the danger, the Biden administration pushed through the CHIPS and Science Act that will provide $52 billion in support for semiconductor companies to build high-end chip fabrication plants in the United States. In addition, the Inflation Reduction Act provides huge amounts for innovative research.

And in a major win, the administration has persuaded Taiwan's TSMC to move some of its chip production to the United States, as a hedge against Chinese intervention. On Tuesday, TSMC announced it will substantially expand a small production plant it is already building in Phoenix, which will now produce chips more advanced than originally planned.

Clearly, TSMC is nervous about China's future moves.

But the Phoenix hub will make only a small dent in U.S. needs — and won't come on line until 2024 at the earliest. This leaves the United States still dependent on factories in Taipei.

Meanwhile, China's president, Xi Jinping, might get impatient and try to squeeze sophisticated chips out of Taiwan through economic or even risky military pressure. "Xi sees China's chip industry as vulnerable to the U.S., because his military systems are evermore dependent on sophisticated chips," Miller said. And Xi's attention is focused on "reunifying" Taiwan with the Chinese mainland.

This means that Americans should pay closer attention to the Chip War and its potential to spark a real war. These tiny silicon wafers, and who will control them, will shape the future of our computer-driven world.

(c)2022 The Philadelphia Inquirer

Visit The Philadelphia Inquirer at www.inquirer.com

Distributed by Tribune Content Agency, LLC.