()

The IRS will not collect federal taxes against state-issued inflation relief payments or tax refunds, the agency said Friday, a reprieve for tens of millions of taxpayers who received the subsidies.

The IRS had previously asked taxpayers to hold off filing their returns as officials determined if the state payments were federally taxable, an unusual statement for an agency that has long called for submitting returns as quickly as possible. Tax filing season began Jan. 23.

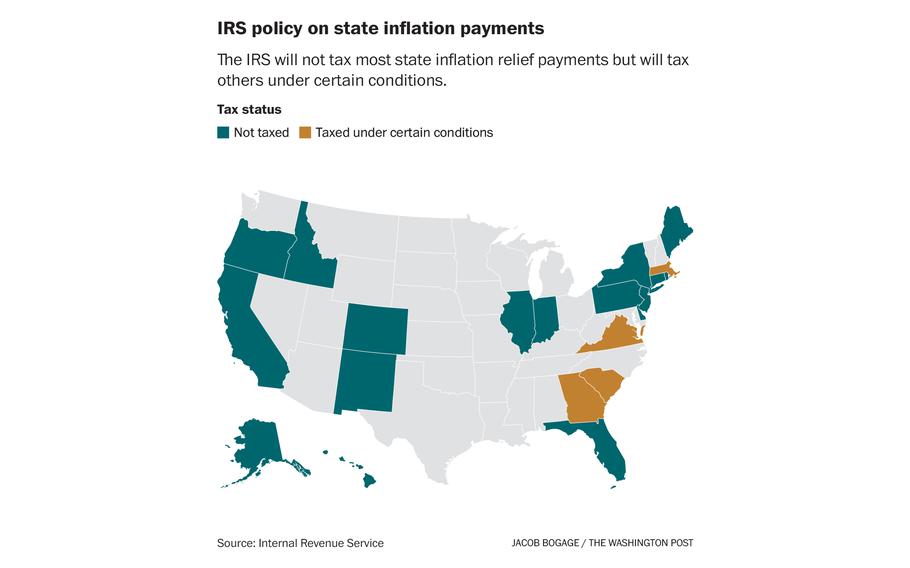

Friday's announcement means taxpayers in more than 20 states can now file their taxes. Residents of Alaska, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island will not have any taxes collected against state payments or tax refunds and do not need to report them on their returns, the agency said.

The IRS said the payments made by those states were "for the promotion of the general welfare or as a disaster relief payment," and therefore are not federally taxable.

People in Georgia, Massachusetts, South Carolina and Virginia will have to report state payments as income, unless the recipient claimed the standard deduction, or itemized deductions but did not receive a tax benefit, the IRS said.

Flush with excess revenue stemming from wage gains in 2021 and 2022, nearly two dozen states issued payments to combat inflation over the summer.

California's middle-class tax refund distributed payments worth between $200 and $1,050; close to 16 million Californians have received the payouts already, and 23 million are eligible. New York awarded inflation relief payments worth $270 for average-to-low-income residents and enacted rent and property tax relief. Oregon sent one-time $600 checks to low-income households, and Georgia gave tax filers a $500 credit after they submitted their 2021 return.

The decision on state payments came on the same day that the IRS reported encouraging service numbers. According to a Treasury Department official spoke on the condition of anonymity to discuss internal data, the agency has answered 88.6 percent of its phone calls from the start of tax filing season through Feb. 4, up from the 13 percent of calls answered during the 2022 tax season and 11 percent the year before.

Factoring in callers who reached automated phone and chat support, 93.3 percent of taxpayers were able to reach IRS resources since the start of tax filing season through Feb. 4. Those automated tools are a major advancement for the outdated taxpayer services systems, allowing filers to obtain basic data without phoning IRS call centers. The treasury official spoke on the condition of anonymity to discuss the internal data.

The Inflation Reduction Act backed by President Biden and other prominent Democrats provided the IRS $80 billion in additional funding over 10 years to improve services and strengthen tax enforcement for high-income earners and corporations.

The tax agency invested in new technology and hired 5,000 workers to staff phones based on funding from that law, the official said. The IRS recently introduced new tools to allow taxpayers to electronically check the status of their amended returns and file non-wage earnings, such as money from gig work.

But the agency has struggled to implement other new provisions, including tax rebates for consumers that purchase American-made electric vehicles. The IRS has left in place broad guidelines from the law include vehicles without the requisite amount of U.S.-made parts, allowing them to remain eligible for the tax break for a longer-than-expected period.

Another of Biden's key legislative victories, the American Rescue Plan Act of 2021, required taxpayers to report transactions worth $600 or more that were made through third-party payment apps, such as Venmo and PayPal. The IRS delayed guidance on that question, too, saying it will not apply until the 2023 tax year.