(The Washington Post)

In just a few months, Yemen’s Houthis have taken an outsize bite out of global shipping - and have begun to threaten the economy of their stated target, Israel.

While Israel, which relies on the Mediterranean more heavily than the Red Sea, has proved resilient, experts warn that the attacks already pose a threat to Israel’s economy and could come to take a greater toll if they persist in the face of U.S.-led airstrikes.

The Port of Eilat, Israel’s toehold on the Red Sea, has seen an 85 percent drop in shipping activity, its chief executive told Reuters last month. Without a reversal, “unfortunately we will likely have to furlough workers,” he told the Jeruslaem Post.

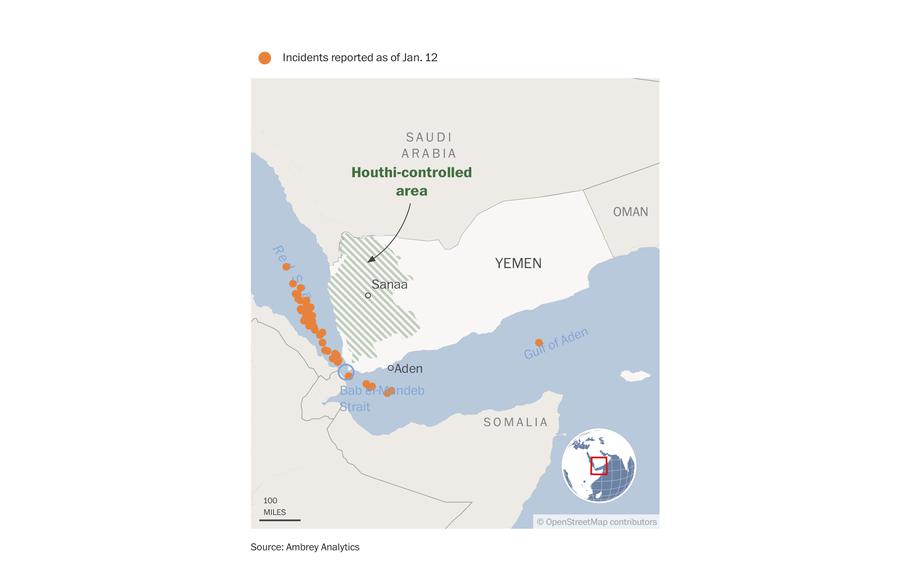

Launching missiles at commercial ships in the Red Sea, a choke point on one of the world’s key maritime routes, turns out to be a sure way to draw the ire of the United States and its allies: Nearly a fifth of freight bound for the U.S. east coast usually passes through the Red Sea, en route to the Suez Canal, per Moody’s, and global shipping giants have begun to send ships the long way around Africa.

The Houthis have maintained that since they began launching strikes, in solidarity with Palestinians under Israeli bombardment in the Gaza Strip, that their primary goal was not to upend world commerce, but to apply pressure on Israel for a cease-fire in Gaza.

Mohammed Abdulsalam, a spokesman for Yemen’s Houthis, told Reuters on Friday that attacks in the Red Sea would remain focused on blockading Israel and retaliating for U.S. and British airstrikes. The attacks, he said, have “represented pressure on Israel only,” not “on any country in the world.”

While most of Israel’s maritime trade passes through Haifa and others ports on the Mediterranean - subject to broader delays in global shipping caused by the Red Sea crisis but not necessarily more so than ports elsewhere - Eilat is a key entry point for some imports from East Asia, including electric vehicles from China, which comprise most of those sold in Israel. Less ability for sellers to build inventory, as fewer cars arrive, could contribute to rising prices, the Times of Israel reported.

As for ships that pass through the Suez Canal to Israel’s busier ports on the Mediterranean, many top carriers have stopped traffic in or out of the corridor, despite a global coalition seeking to provide safe passage for ships, as well as U.S.-led attacks on the Houthis in Yemen. Danish shipping giant Maersk said this month it was diverting all of its vessels south - all the way around Africa - “for the foreseeable future.”

The shipping industry has responded to the Houthis’ focus on shipping to Israel. Evergreen, the Taiwanese shipping giant, said last month it would “stop accepting Israeli cargo” immediately “for the safety of cargo, ships and crew.” Maersk last month introduced a surcharge on shipments to Israel to help cover rising insurance costs. Consumers, ultimately, could bear the brunt of higher insurance prices.

Even small changes to the supply chain can pose major challenges for the supply of medical supplies amid an “unprecedented number” of war casualties, said Moshe Cohen, chief executive of Yad Sarah, the largest nongovernmental medical supplies lender in Israel. Delays caused by Houthi strikes could “pose a life-endangering delay of critically needed supplies,” he said in an emailed statement.

Israel’s economy is facing broader obstacles as it deals with the fallout from its war in Gaza, which has killed at least 24,927 people in Gaza and began after the Oct. 7 attack by Hamas killed about 1,200 Israelis. Thousands of workers have been called up to fight.

The Bank of Israel said this month that its forecast for Israeli exports in 2024 was down 1 percent from its forecast in November, when the Houthi attacks picked up pace. The figure excludes diamonds and start-ups, and includes services such as tourism, which has declined amid the conflict. Civilian imports are forecast to fall by 4 percent next year, a 5 percent drop from its expectations in November, according to the central bank. Imports from Asia, which usually route through the southern mouth of the Red Sea, where the Houthis are striking ships, are likely to be the most heavily affected. China is the largest exporter to Israel, making up more than 14 percent of Israeli imports in 2021, according to the Observatory of Economic Complexity, which tracks economic data.

The global economic impacts of the Red Sea strikes, rather than specific effects on Israel, could come to be the larger source of pressure, contributing to a sense among Israel’s allies that the entire region could spiral into violence. As long as the war in Gaza continues, the risks that the situation in the Red Sea degrades further and that regional skirmishes such as on the Lebanese border develop into war “increase exponentially,” said Dan Arenson, a geopolitical risk adviser at J.S. Held, a global risk consultancy. “I think the Biden administration gets that.”

Increased maritime shipping rates from China to North America are forecast to drive consumer prices up, according to a report Tuesday by Freightos, a freight quoting firm. If the U.S. economy is hit by the Houthi attacks, that could push President Biden to press Israel to wind down its war in Gaza, Arenson said. “Patience is very clearly starting to run thin,” he said. Biden administration officials, including Secretary of State Antony Blinken, have in recent weeks struck a harsher tone with Israel amid concern over the mounting civilian death toll and rising regional tensions.