()

As a mom of a member of the armed forces, I understand some of the financial challenges that our enlisted service members and their families experience. Between frequent deployments and relocations, as well as the complex and unpredictable nature of military pay, there are unique challenges that can be disruptive to short- and long-term financial planning. But it doesn’t stop there. Once our service members transition into civilian life, they encounter new realities, such as the loss of active-duty benefits, health care considerations, housing needs, and of course, finding employment.

According to a recent Experian survey, 65% of U.S. adults experience negative thoughts, flashbacks and/or anxiety when dealing with financial issues. That’s reflective of the overarching population. Imagine if the survey was specific to members of the military and their families.

Navigating the mainstream financial system can be difficult without some of the burdens that our current and former members of the armed forces face. These additional obstacles can make the process even more overwhelming and stressful. That’s why it’s important to connect our service members and veterans with the tools, resources and financial knowledge to take control of their financial future.

Taking the initial step

Every person’s financial journey is unique. There isn’t a one-size-fits-all approach to tackling life’s financial challenges; however, there are steps people can take to set themselves up for future success:

Create a budget. It’s a basic concept, but it’s also the foundation of managing finances. A realistic budget allows service members and veterans to better understand where their money is going and live within their means.

Cut back on the non-essentials. Identifying the expenses that you can redirect toward paying down existing debt or contributing to emergency funds, savings or retirement accounts, is one step closer to achieving financial independence.

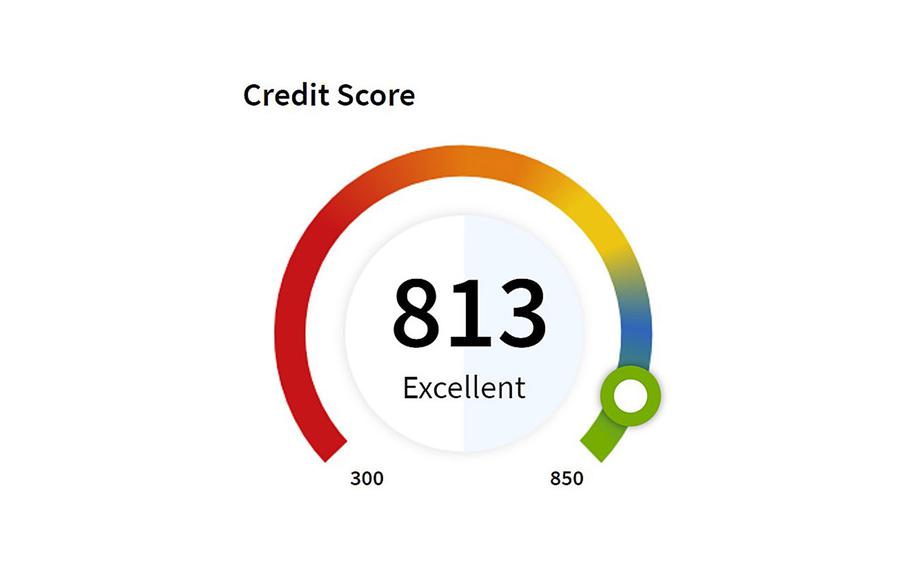

Build credit. Good credit can help you qualify for lower rates and better loan terms. Making small purchases and paying them off on time each month can help you build a positive credit profile.

Finding trustworthy resources

The survey also found that 55% of Americans expressed that access to more financial education would help alleviate their financial stressors, yet 37% of U.S. adults are unaware of where to access trustworthy information about financial literacy. Ensuring members of the armed forces have access to the tools and resources to further their financial knowledge is paramount to success.

For instance, active-duty personnel and their families have access to family readiness centers on military bases, where counselors provide free financial education training, assistance with moving during station changes or deployment, as well as other military life challenges.

In addition, organizations such as Support the Enlisted Project (STEP) have been at the forefront of bringing financial literacy to service members. They are not only helping military families with short-term financial assistance, but also working with them to better understand financial and credit concepts that can open doors of opportunity.

For many service members this starts with talking with someone about financial goals and needs. STEP provides counselors for one-on-one discussions with each family, utilizing a holistic approach to personal finance. Veterans have reported leaving STEP with a better understanding of their financial situation and a personalized plan to achieve their goals.

Credit counseling with reputable and certified credit counselors can help teach ways to efficiently pay off debt and create a working budget. While guidance from a professional credit counselor can benefit anyone, it can be especially helpful for service members struggling with credit card bills, battling bankruptcy or feeling buried in debt.

A better future

STEP and other community, mission-driven organizations are helping to build a sound financial future for military personnel. More and more financial institutions are introducing products and services to assist service members.

The more financial literacy programs available to current and former members of the armed forces empowers them to achieve their financial goals.

Abigail Lovell is Experian’s Global Chief Sustainability Officer.